[ad_1]

Authored by Simon White, Bloomberg macro strategist,

A complete assurance of all financial institution deposits would spell the finish of ethical hazard and mark the ultimate chapter of the dollar’s multi-decade debasement.

It is said the protect-up is even worse than the crime. With the latest banking disaster in the US, it is the clear-up that could conclude up performing much more lasting injury. The failure of SVB et al prompted the FDIC to promise that all depositors will be produced entire, whether insured or not.

The precedent is currently being set, with Treasury Secretary Janet Yellen commenting on Tuesday that the US could repeat its actions if other financial institutions grew to become imperiled. She was referring to more compact creditors, and denied the up coming working day that insurance would be “blanket”, but presented the regulatory way of vacation in excess of the final forty a long time, this will inevitability utilize to any financial institution when press comes to shove.

This marks the conclude of moral hazard and, ultimately, the closing desecration of the Fed’s equilibrium sheet.

The dollar is a liability of the central financial institution therefore, this would mean additional erosion of its authentic value, compounding the decimation of its getting electrical power seen around the last century.

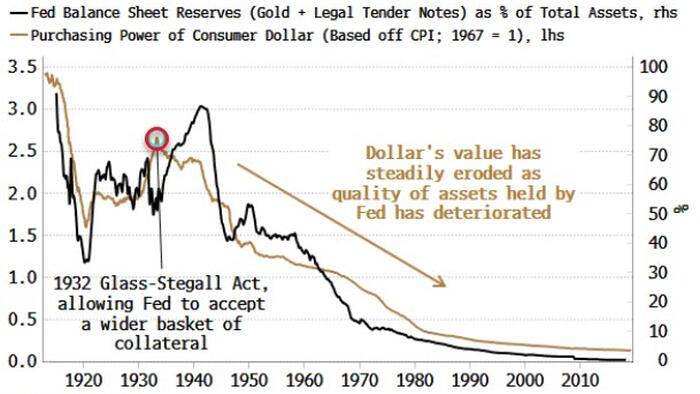

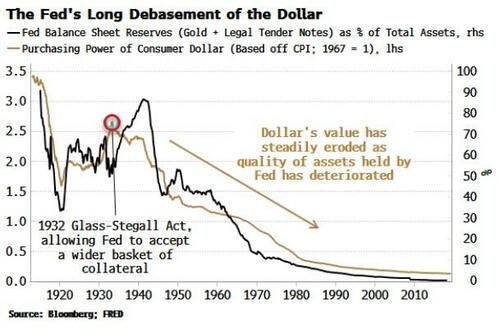

The 1932 Glass-Stegall Act was the beginning of the close, letting the Fed to settle for a broader basket of collateral it could lend in opposition to: riskier belongings these types of as for a longer time-term Treasury securities. The falling high quality of collateral has continued, with the Fed lending versus corporate personal debt in modern a long time.

The finish final result is the Fed’s stability sheet has steadily deteriorated, and with it the real price of the greenback.

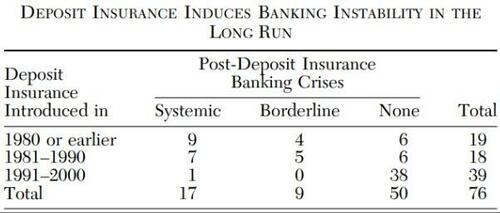

A de facto enlargement of insurance to all deposits will direct to a further erosion in the Fed’s equilibrium sheet. Why? To start with, notice that deposit-insurance policies strategies usually lead to less, not far more, bank security.

Several studies have revealed that nations around the world with deposit-insurance policies techniques are likely to see far more bank failures. The more generous the plan, the greater the instability.

Resource: Columbia College

Moral hazard instills self-discipline in depositors as they shell out focus to the bank’s credit hazard (a little something many depositors in SVB signally failed to do.) It also imposes self-discipline on banking institutions, incentivizing them to structure their money flows so that they match through all time, hence mitigating the hazard of financial institution operates (cue SVB once again).

Why, then, would increased banking instability guide to a additional deterioration in the Fed’s harmony sheet? It arrives down to how US banking has developed more than the past century.

Financial institutions will have to deal with dollars flows from assets and liabilities, and their desire is to lessen their money situation each and every evening in purchase to maximize the successful use of their capital. There is normally a “position making” instrument, a liquid asset that banks can use to park excess hard cash or make up for shortfalls just about every day.

In the early days of the Federal Reserve program it was professional loans and USTs now it is principally the repo market. A bank can “make position” if it can repo in or repo out securities for money. But if the marketplace for that collateral freezes up, they’re useless.

This is in which the Fed actions in – but as the “dealer of past resort” fairly than the loan company of last vacation resort.

To make certain market liquidity, the Fed need to underwrite funding liquidity. And to do that it should be inclined to take as collateral no matter what the banking sector’s position-producing devices are. If it doesn’t, the game’s up.

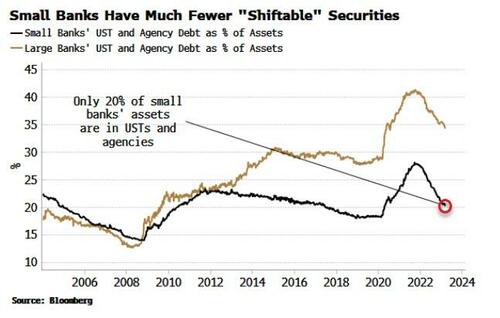

SVB happened to have a superior proportion of USTs and property finance loan-backed securities on its stability sheet, creating the Fed’s lifetime effortless in building the BTFP (Bank Phrase Funding Plan), which accepts govt and govt-backed collateral. But this does not get to the coronary heart of the dilemma. Only a fifth of small banks’ belongings are at present shiftable on to the Fed’s equilibrium – considerably less than for bigger creditors — leaving them noticeably exposed.

Deposit insurance plan only mitigates banks’ vulnerability to financial institution operates it does not insulate them from liquidity or insolvency danger. SVB et al are extremely probably not the only fragile US financial institutions, and as the financial system slows, asset selling prices fall and delinquencies and bankruptcies increase, we are very likely to see additional financial institutions needing assist.

The rational final result is that the Fed will have to ever more settle for poorer quality collateral — especially from smaller sized banking companies, with their massive exposure to residential and industrial true estate. We have been listed here before, when in the course of the pandemic the Fed commenced to take the corporate debt of even junk-rated providers.

Minsky himself stressed the centrality of banking to economical security, noting that imprudent banks (read: running without having moral hazard) are far more likely to finance unproductive assignments, which then potential customers to inflation.

So there we have it. Inflation and a further debasement of the Fed’s harmony sheet.

With an abnegation of moral hazard, the lengthy-expression worth of the greenback doesn’t stand a chance.

Loading…

[ad_2]

Supply backlink