[ad_1]

A new report revealed by the AidData research lab at Virginia’s University of William & Mary sheds some mild on the commonly nontransparent follow of Chinese bilateral crisis financial loans.

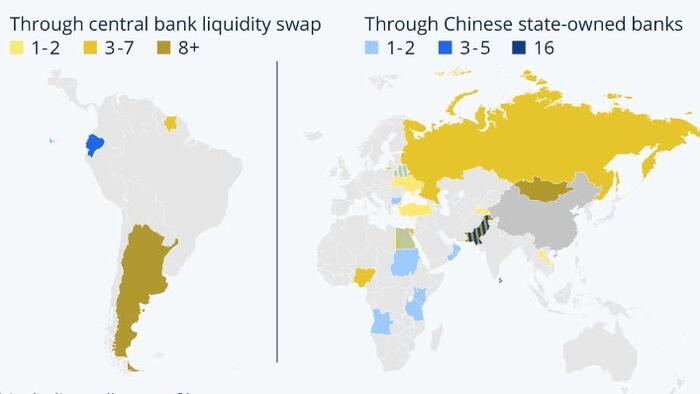

As Statista’s Katharina Buchholz reviews, the scientists that also hail from the Planet Bank, Harvard University and the Kiel Institute for the Environment Economic climate identified 22 nations around the world that ended up bailed out by Chinese financial loans when they ran into liquidity complications in between 2000 and 2021.

You will locate far more infographics at Statista

Nations around the world that utilized these financial loans in an particularly higher selection of decades, i.e. rolled over their financial loans into subsequent yrs include Pakistan, Mongolia, Argentina and Sri Lanka.

The latter country tapped China’s central lender for the initially time in 2021 just before defaulting on its credit card debt in any case in 2022. Argentina and Mongolia have been also identified by the report as countries that have been in dire money distress since the early 2010s and ended up making use of China as a financial institution of very last vacation resort even with the country’s bank loan terms getting fewer favorable than reduce-curiosity bailouts available by the IMF or the U.S. Fed. The list of Chinese bailouts also incorporates nations dealing with big inflation functions, like aforementioned Pakistan, Turkey and Egypt.

The report finds that recurring rollovers of the Chinese financial loans presented by central financial institution liquidity swaps place them in a dubious grey space that set them aside from related lending methods, for example liquidity swaps by the U.S. Fed. These are also frequently applied in crises conditions but ought to be paid again inside of 12 months or declared as true personal debt. The Fed financial loans are most normally made use of by developed nations, whilst building and middle-profits countries – numerous of them also having accumulated common financial debt to China – have been significantly turning to the Asian superpower for crisis assist. These nations around the world have therefore been equipped to hold on to swap lines for expended periods of time without obtaining to declare extra exterior financial debt, but at a better price and at a reduction of transparency in worldwide personal debt.

Bailout amounts provided by China remained rather minimal in the 2000s and early 2010s, prior to taking pictures up from 2015 onwards, climbing to a total of $100 billion for the two many years. The two most frequent means in which these loans function is by a liquidity swap with the Chinese Central Financial institution – where most of the superb balances of all over $40 billion were situated as of 2021 – or by credit lines from Chinese state-owned banks. Three international locations, Venezuela, South Sudan and Ecuador, received prepayments on goods they ended up to deliver to China.

Loading…

[ad_2]

Resource backlink