[ad_1]

(Bloomberg) — Blocked border crossings, a minister pelted with eggs and overflowing silos — anger is mounting among farmers in jap Europe who say a hurry of grain from Ukraine threatens their companies, and it is steadily eroding political goodwill.

Most Study from Bloomberg

Poland and other neighboring states agreed to aid get grain out of Ukraine and on to worldwide markets right after the Russian invasion blocked exports past yr. Aspect of that offer is now piling up in jap Europe, and it’s threatening nearby livelihoods.

The surplus has been created by infrastructure bottlenecks as effectively as farmers delaying providing final year’s generate. The hoard of grain is starting to be a political situation as protests spill into the streets.

Local growers held on to their crop in anticipation of better prices pursuing the war. A broader world-wide downturn has as an alternative pushed prices down, leaving farmers in Poland, Romania, Slovakia, Hungary and Bulgaria struggling with lower income and having difficulties to empty their stockpiles ahead of the new harvest starts in the summer season.

Political leaders, who rushed to assistance Ukraine initially, are setting up to complain.

“We have to help Ukraine in the transport and sale of grain to nations around the world outdoors the EU,” Polish Primary Minister Mateusz Morawiecki, who four months ago was featuring $20 million to assist Ukraine export its grain to Africa, stated in a Fb write-up. “But this simply cannot be carried out at the price of Polish farmers and neighborhood marketplaces.”

The European Fee desires to limit the amount of Ukrainian provide entering the European Union simply because it is destabilizing nearby marketplaces, he reported.

The glut is incredibly much a local a single. Ukraine’s exports to worldwide markets are nevertheless properly below pre-war concentrations as a deal to get grain out of Black Sea ports remains tenuous.

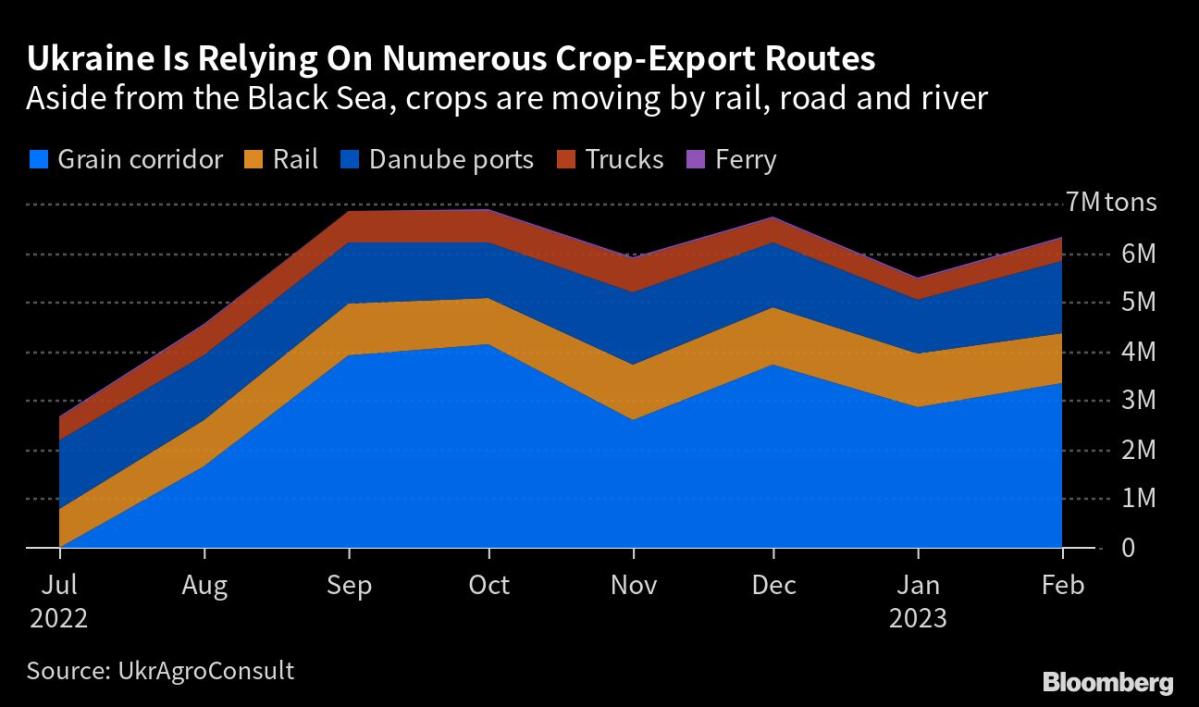

Russia’s invasion triggered worries about a worsening starvation disaster as foods rates jumped to record levels with huge amounts of Ukraine’s grain and vegetable oil stranded. Governments were being forced to bounce in to retain materials flowing, with jap Europe emerging as a transit route. Even though some ports have reopened, the speed of shipments is restrained. Transport by rail, highway and river continues to be crucial.

Imports into Poland rose to 2.45 million tons in 2022 from just about 100,000 tons in earlier years, which turned into a massive undertaking for the rail network. Rolling inventory had to be adjusted because tracks have been diverse from those people in Ukraine, holding up shipments. Precedence on trains was also specified to coal that Poland was pressured to import soon after banning Russian offer.

Race Versus Meals Inflation Begins on Rusty Soviet Rail Tracks

Poland’s Agriculture Minister Henryk Kowalczyk informed producers in June not to promote their grain for the reason that price ranges are unlikely to tumble. But benchmark Chicago wheat futures have virtually halved from the documents arrived at just after the outbreak of the war as large harvests in other critical shippers, like Russia and Australia, quelled fears about a offer shortfall.

Grain import desire is also easing in vital locations like North Africa — a person of the EU’s main wheat markets — as economies there falter, reported Helene Duflot, wheat analyst at Strategie Grains.

On March 17, a group of farmers dressed in yellow vests and blowing whistles, mobbed Kowalczyk at an agriculture good in Kielce in southern Poland. He was forced to flee the location.

5 times later on, the minister was heckled and pelted with eggs in the course of a panel discussion with EU Agriculture Commissioner Janusz Wojciechowski in the city of Jasionka, a two-hour drive from the Ukraine border. Earlier this week, Kowalczyk agreed to an approach that involves at minimum 10 billion zloty ($2.3 billion) in help and a pledge to increase the capability of ports.

Farmers having said that are not allowing up, promising to resume protests unless the scenario improves above the upcoming two to a few months.

Political Fallout

The discontent could have political effects. Poland and Slovakia face elections later this 12 months and farmers are an crucial constituency. A previous Slovak leading who rejects sanctions from Russia and weapons deliveries to Ukraine is main in the polls. Bulgaria is in a comparable scenario, with polls thanks this weekend. Poland has recognized more than a million Ukrainian refugees and has been among the the biggest contributors of armed service and humanitarian assist to Kyiv.

Romanian farmers traveled to Brussels on Wednesday to protest in entrance of the European Commission constructing, waving banners stating “Romanian Farmers Ought to have Respect!” The region, a single of the EU’s biggest corn and wheat producers, has facilitated much more than 50 % of Ukraine’s grain exports by land given that the start off of the war.

Imports rose to 570,000 tons past 12 months from shut to zero, according to Razvan Filipescu, vice-president of the Affiliation of Farmer Producers in the Dobrogea location.

President Klaus Iohannis reported the bloc’s disaster fund of €56 million ($61 million) for farmers was insufficient, though also criticizing it for failing to variable in the “huge sacrifices” created by the Balkan country.

In a letter to European Fee President Ursula von der Leyen, Bulgaria and the 4 EU states bordering Ukraine pushed for the bloc to improve fiscal aid to farmers, consider purchasing the surplus grain for humanitarian aid or even restrict imports from Ukraine.

Slovakia wants the EU to do the job with the UN’s Entire world Meals Programme to guarantee Ukrainian grain is transported out of member states, in accordance to a person acquainted with the discussion, who asked not to be named simply because the talks are personal.

Even now, Ukrainian provide could also participate in a aspect in plugging any shortfalls in Europe. Drought across the EU previous summer time ravaged its domestic corn harvest, necessitating further imports to fill the hole. Shipments although are likely to ease in the months forward as the war hits harvests.

“The entire exports from Ukraine will decrease, which include to the EU, which is clear,” explained Alex Lissitsa, main government officer of Ukrainian agribusiness IMC.

Fears are also rising that the grain transit agreement itself may well be damaged.

“Nobody oversees the gentleman’s settlement that Europe will be a transit territory for Ukraine’s grain to Africa,” mentioned Emil Macho, chairman of the Slovak Agriculture and Foods Chamber. “It’s not operating, the grain is staying ideal right here.”

Meanwhile, anger carries on to spill around. In Bulgaria, grain producers blocked border crossings with neighboring Romania for a few times, demanding compensations. Practically 80% of the 2022 sunflower crop stays unsold and farmers hold far more than 3 million tons of wheat from very last 12 months, stated Krasimir Avramov, founder of the country’s Countrywide Association of Grain Producers.

Wieslaw Gryn, 65, is growing corn, wheat, canola and beetroot on a 320-hectare (791-acre) family members farm in Rogow in eastern Poland. He says grain costs are down 40% and he continue to has hundred of tons to offer.

“Each 12 months all around this time I would have some surplus. But I have by no means had this kind of a massive surplus as appropriate now,” Gryn claimed in an interview. “My business enterprise associates are delaying payments and I need to have the income because I must start off to develop my grain appropriate now.”

–With support from Slav Okov, Daniel Hornak and Natalia Ojewska.

Most Study from Bloomberg Businessweek

©2023 Bloomberg L.P.

[ad_2]

Source url