[ad_1]

Authored by Conor Gallagher through NakedCapitalism.com,

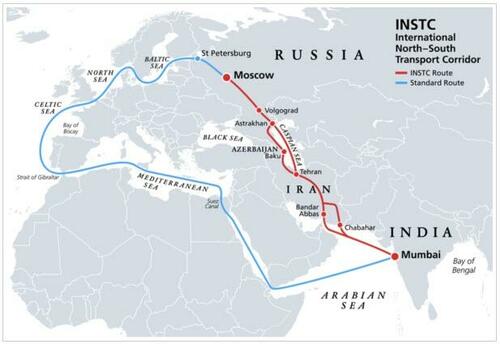

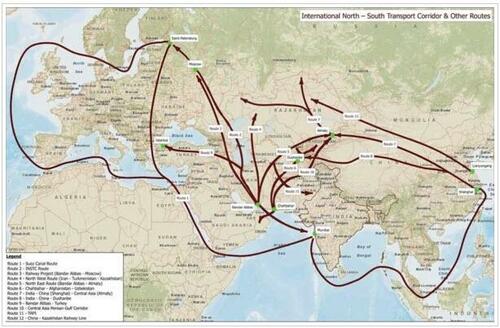

The Riyadh – Tehran detente offer could be a significant get for not only the Middle East but also much larger assignments seeking much more integration of bigger Eurasia. If the offer is executed, China’s Belt and Street Initiative could turn out to be a vital part of the economic futures of equally Saudi Arabia and Iran. The rapprochement could also pay back dividends for the Worldwide North-South Transportation Corridor (INSTC) task, which runs from St. Petersburg to Mumbai in India by means of Azerbaijan (or the Caspian Sea) and Iran and throughout the Arabian Sea. The “sanction-proof” corridor connects the Indian subcontinent with Russia without having needing to go by means of Europe although at the same time getting 30 per cent much less expensive and 40 % shorter than the current routes.

Following the announcement of the Saudi Arabia – Iran rapprochement deal brokered by China, the chairman of the Russian Condition Duma Committee on International Affairs Leonid Slutsky praised the deal and stated how it corresponds with Russia’s collective protection thought for the Persian Gulf location. He paid out individual awareness to the INSTC, declaring:

In this regard, I watch the Intercontinental North-South Transportation Corridor undertaking, which will become the critical element for beneficial feed-back for safety, balance and progress in this most critical region, as a strategic a single. The launch of the Corridor will become a milestone occasion not only in logistics, but also in politics and in stability architecture of the Greater Eurasia, it will become the most significant economic superstructure atop the strategic foundation, accomplished in Beijing.

The INSTC was declared back in the early 2000s, but progress was sluggish right until just lately when the West’s actions place it into overdrive. The sanctioning of Moscow and Tehran and the severing of Europe from Russian energy established the incentive to speed up investments by crucial stakeholders. The authorities in Tehran know their centrality on the India-Russia trade route, and taking into consideration that India’s imports from Russia quadrupled previous year, a person can deduct the possible upside for Iran. With an investment increase from Russia, Tehran has been striving to pace up the completion of enhanced railway networks that will link to the current railways of Russia and Azerbaijan and Chabahar Port in southeastern Iran.

Still the main impediment to the INSTC reaching its complete probable continues to be Iranian infrastructure. Much of the transit of items on the INSTC continue to takes area on streets in Iran. A great deal of Iran’s railway is single track, and frequent container practice expert services from Moscow to Iran have to depend on transloading.

The governing administration in Tehran is making an attempt to prioritize the enhancement of port capability, rail and road infrastructure, transportation terminals and the modernization of its transportation fleet. The Iran Chamber of Commerce, Industries, Mines and Agriculture is also starting off a new Transports Internationaux Routiers or International Road Transport middle in the southern port town of Bandar Abbas to expedite the processing of transit cargoes. However, there is a apparent will need for even further investment in transportation infrastructure, which has been challenging thanks to US sanctions on Iran.

Saudi Arabia’s Finance Minister Mohammed Al-Jadaan explained March 15 that Saudi investments into Iran could come about “very quickly” subsequent the agreement to restore diplomatic ties. He added that he does not see any impediment as extensive as the phrases of agreements are highly regarded by Tehran.

Any Saudi financial working with Iran would undercut US sanctions imposed to stress Tehran, if not violating them outright. With tens of billion of bucks in Iranian assets blocked around the globe, the prospect of Saudi investments could jumpstart the INSTC and help preserve the peace in between Riyadh and Tehran.

China’s motivation to preserve the peace could also bring investments. Scott Ritter writes at Electricity Intelligence:

With China providing infrastructure-making expense capital through its Belt and Highway Initiative, the new Iran-Saudi détente could evolve into a regional financial relationship that supplants the US-led defense interactions that have defined Center East politics for many years.

China would have to operate all-around US sanctions in order to enhance investments in Iran, but the two nations around the world have now uncovered a workaround to keep on the oil trade, with most getting rebranded as from a 3rd country. If a China have been to up its investments in Iran, it would mark a change. From Silk Road Briefing:

Russia has now overtaken China as the major trader in Iran. This follows Moscow’s conflict with Ukraine from late February previous yr, as a outcome of which Iran and Russia have strengthened their financial and expenditure ties. The UAE, Afghanistan, Turkey and China are the up coming greatest buyers. Though China that was expected in Iran to be the key trader, Beijing minimized its exposure in 2022, and concentrated much more on investing into the Belt and Road Initiative infrastructure such as logistics centers, border facilities and so forth. that would facilitate its possess export capabilities to Iran and the region.

Overseas financial investment flows to Iran have been reducing from 2012-13 when the quantity stood at US$4.5 billion. The cheapest stage was recorded in 2015-16 with only US$945 million of FDI inflows. UNCTAD estimated that the volume of FDI inflows to Iran stood at US$3.372 billion, US$5.019 billion, US$2.373 billion and US$1.508 billion from 2016 to 2019.

In accordance to the United Nations Meeting on Trade and Improvement, Iran attracted an believed US$1.425 billion in Foreign Immediate Investment in 2021 to register about a 6% rise in comparison to US$1.342 billion in 2020. In 2022, nonetheless, and irrespective of the sanctions, the complete volume of investments captivated to Iran hit US$5.95 billion. Out of this determine Chinese organizations invested only about US$185 million.

On top of that, Secretary of the Iranian Supreme National Security Council, Ali Shamkhani, introduced on Monday that Tehran concluded an agreement with the United Arab Emirates to aid trade motion involving the two international locations utilizing the Emirati currency, the dirham.

The UAE has not verified any these kinds of agreements as it would run afoul of US sanctions, which have produced a money crunch in Iran. Tehran is hoping that superior ties with Persian Gulf Arab nations can help cut down that strain. It continues to be to be found how significantly these nations will go in buy to give Iran an economic lifeline.

But ought to diplomatic and financial relations amongst GCC members and Iran proceed to enhance, it could spell the stop to US efforts to use “maximum pressure” on Tehran and another nail in the coffin of US affect in the location. It would also cement Iran’s placement as important nexus in new world-wide trade routes like China’s BRI and the INSTC.

The US, by making an attempt to put maximum economic tension on Iran and Russia, hinting that China is future, and the sick-fated oil price cap, has only served travel the integration of Russia, China, Iran, Saudi Arabia, and much more.

Irrespective of all the sanctions and western tension on international locations to isolate Moscow, Russian trade is on the upswing. Iran is keen to income in on its placement involving India and Russia, who are speedily raising their trade quantity. From India Shipping and delivery Information:

Ruscon, a primary multimodal transport logistics service provider in Russia, has significantly expanded its containerized support community from the Black Sea Port of Novorossiysk to Nhava Sheva and Mundra in west India as volumes fast increase.

The enterprise, a Deli Team subsidiary, has now amplified its tonnage deployments from 1 vessel to four vessels to supply a weekly sailing frequency on the route.

Furthermore, an added stop has been launched at Saudi Arabia’s Jeddah Port. The company rotation presently incorporates a phone at Istanbul Port in Turkey.

In accordance to Reuters, Russia started exporting diesel to Saudi Arabia in February following the EU enacted its embargo on seaborne imports of Russian oil. The Saudis are now expected to export the Russian diesel to other nations after some refining.

Russia’s largest ocean container provider, Significantly Eastern Shipping Co., also not long ago extra a direct Novorossiysk to Nhava Sheva route. And many other nations are jumping in and furnishing vessels immediately after western sanctions compelled normal mainline operators to halt operations into and out of Russia. Even the New York Moments begrudgingly admits:

Ami Daniel, the main government of Windward, a maritime information firm, mentioned he had found hundreds of situations in which persons from international locations like the United Arab Emirates, India, China, Pakistan, Indonesia and Malaysia acquired vessels to try to established up what appeared to be a non-Western investing framework for Russia.

India’s imports of crude oil from Russia achieved a file of 1.6 million barrels for every day in February, which was extra than one particular-3rd of India’s imports and much more than the mixed imports from classic suppliers Iraq and Saudi Arabia.

India has been making a gain turning around and advertising the refined oil to the US and EU, which are not able to order directly from Russia owing to sanctions. The similar tale is transpiring in North Africa, which purchases up Russian crude and will increase provides to Europe as a sanctions workaround.

Russian wheat and fertilizer exports also rose in 2022 regardless of sanctions, significantly of the previous likely to the Middle East and North Africa (MENA) region, which is the top rated place for Russian foods exports. Substantially of the fertilizer went to INdia.

Iran and Russia are cooperating to build ships and vessels in the Caspian Sea. In October, Iran declared Moscow’s readiness to make it possible for Iranian ships to pass as a result of the Volga River. Russia experienced formerly not allowed overseas ships to use the Volga River or the Volga-Don canal, but if the agreement is applied, Iran will have accessibility to the longest river in Europe, and have accessibility to the Volga-Don Canal, which supplies the shortest connection involving the Caspian Sea and the Mediterranean.

For yet another appear at how Western sanctions are backfiring and only drawing international locations closer to countries the US is attempting to isolate, get the Eurasian Economic Union (EAEU) users of Belarus, Kazakhstan, Armenia and Kyrgyzstan, which are also all staying boosted by anti-Russian sanctions. From Silk Street Briefing:

It has had the unanticipated outcomes of boosting regional GDP advancement prices: in their “Regional Financial Prospects” report, the European Financial institution for Reconstruction and Growth (EBRD), analysts noted that Kazakhstan’s 2022 GDP expansion reached 3.4% in its place of the beforehand predicted 2%.

Component of that has been thanks to sanctions, with an enhance in revenue due to the re-export to Russia of desktops, household appliances and electronics, car elements, electrical and digital elements. Exports of non-electricity products from Kazakhstan to Russia in 2022 improved by 24.8% and amounted to US$18.9 billion. …

An EAEU Intergovernmental Council conference held in early February this 12 months showed that the financial condition in all EAEU members states is secure, and mutual trade is developing. Anti-Russian sanctions basically considerably add to this advancement, meaning that for EAEU members in particular, as nicely as nations these as China and India, the attractiveness of Russia as an financial partner has developed.

India, Turkey, and Egypt are amongst the nations around the world speaking about absolutely free trade agreements with the EAEU. And Iran signed just one in January. The major driver for the Iran-EAEU integration is to up grade Iran’s transport and logistics infrastructure, i.e., the INSTC.

The worth of the INSTC and its backlink to the Middle Corridor, which enables Russian targeted traffic to head east by using Kazakhstan to China, and vice-versa, is escalating to include the total region. At a joint press briefing with US Secretary of State Anthony Blinken in February Kazakhstan’s International Minister Mukhtar Tleuberdi created it very clear that EAEU financial participation is important for Astana, and Kazakhstan would not be opting out of these a effective arrangement in buy to you should the US.

It was just a different reminder of how the INSTC and Center Corridor depict the growing integration of the EAEU, MENA, China, and India, and the US’ fading impact.

Loading…

[ad_2]

Resource connection