[ad_1]

Economic climate

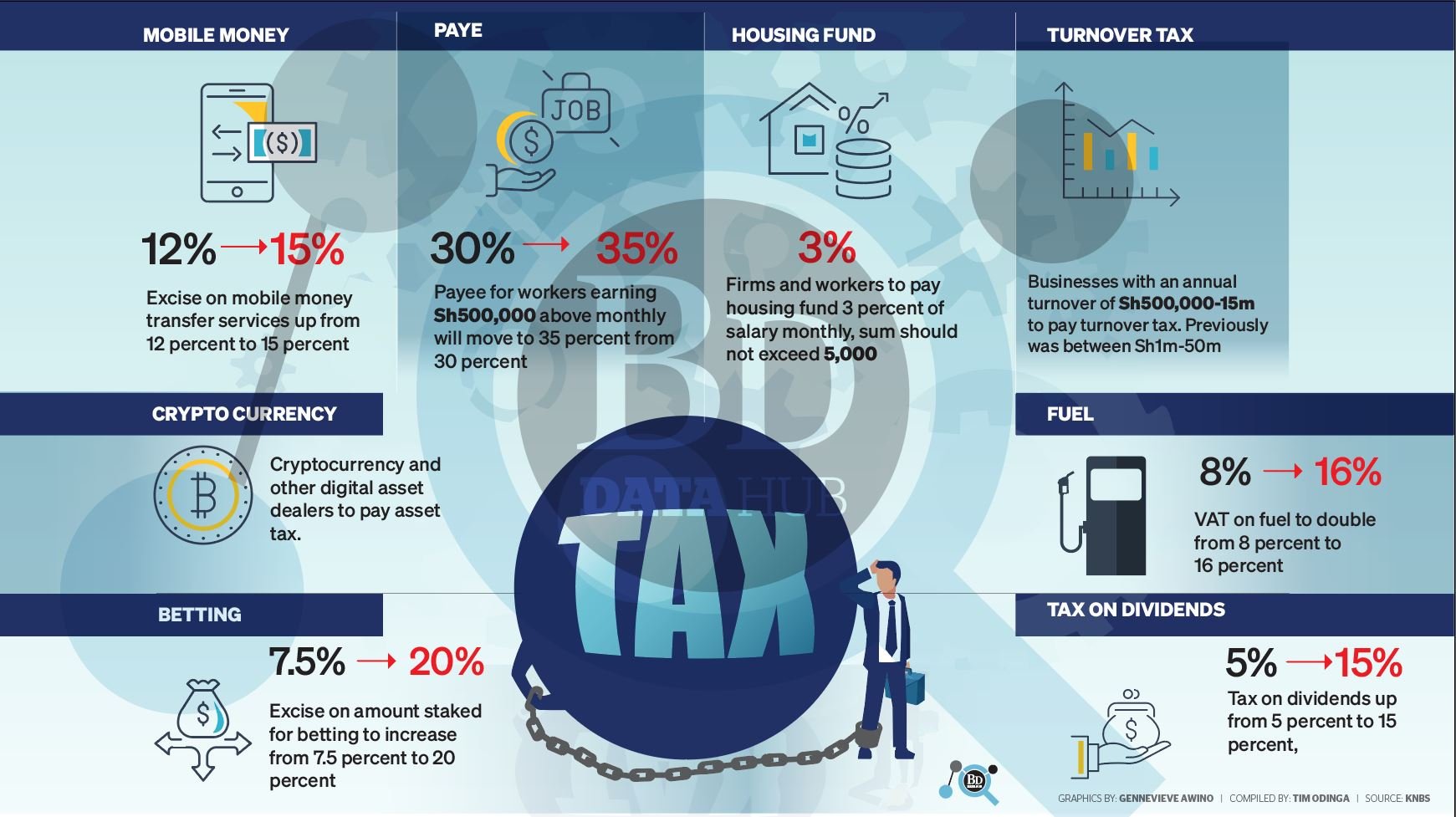

How new taxes will hit gas, M-Pesa charges and salaries

Friday Could 05 2023

GRAPHIC | GENNEVIEVE AWINO | NMG

The Treasury is focusing on leading profits earners, M-Pesa transactions and gasoline people to raise an extra Sh364 billion in taxes for the new funds in a revenue collection strategy that will see workers’ shell out, presently ravaged by inflation, shrink additional.

The best money tax amount will rise to 35 per cent from 30 p.c for personnel earning higher than Sh600,000, who will pay back an extra tax of at the very least Sh5,000 regular.

President William Ruto’s administration has proposed to boost the excise obligation on cellular revenue transfer costs from 12 per cent to 15 per cent, placing the stage for a overview of M-Pesa transfer costs.

The Treasury in the recently released Finance Bill also deleted sections of the regulation that allowed the halving of value-extra tax (VAT) on all petroleum items to 8 %.

This indicates that the price tag of petrol and diesel could improve by Sh13.20 and Sh10.50 a litre centered on the current price ranges.

This seems to be established to pile far more force on homes since the expense of power and transportation has a substantial weight in the basket of items and solutions that is used to measure inflation in the region.

Read through: New tax strategy superior but progress with care

Past year marked the very first time in a 10 years that genuine wages, adjusted for inflation, have contracted for 3 consecutive years, pointing to a rough ecosystem in which workers’ salaries have not kept rate with the spike in rates of fundamental commodities.

Inflation wiped out the 5.6 % salary enhance made available to private sector personnel previous year.

The workers’ payslips will shrink even further as the Treasury seeks to deduct three p.c of all employees’ standard salaries toward a Countrywide Housing Progress Fund to assist ownership of inexpensive residences.

This will come on leading of increased monthly contributions to the National Social Protection Fund (NSSF) and the National Medical center Insurance policy Fund (NHIF), even further shrinking the worker’s just take-house pay.

The month-to-month NSSF contributions enhanced additional than 4-fold to Sh1,080 a month from Sh200 in February while NHIF customers will pay out 2.75 % of their salaries from the latest most of Sh1,700.

Households are sensation the squeeze throughout Kenya, where by rocketing food and gas prices have propelled the charge of inflation above the government’s preferred cap of 7.5 per cent considering the fact that June past yr.

Inflation eased to 7.9 p.c past thirty day period from 9.2 p.c in March on moderation of development in food stuff price ranges.

Companies are warning it will choose a long time for spend raises to return to pre-pandemic amounts, with corporations fretting about organization uncertainties in spite of the financial rebound next the easing of steps aimed at curbing the distribute of Covid-19.

The private sector enhanced wages by an common of 8.1 % in 2019, months in advance of Covid-19 struck Kenya, triggering layoffs, spend cuts and business enterprise closures.

The Treasury in 2018 unsuccessfully proposed to hit Kenya’s massive earners with a 35 % leading tax amount as aspect of the quest to raise revenue tax revenues.

The selection of Kenyans earning much more than Sh500,000 a month is smaller presented the majority of people in formal employment or in excess of 87 per cent of them generate a lot less than Sh100,000 per thirty day period.

President Ruto has revived a proposal to impose larger taxes on Kenya’s tremendous-wealthy and superior-revenue earners, endorsing the introduction of a prosperity tax that failed to sail as a result of Parliament in excess of the previous 4 yrs.

The strategy is the latest in a extended list of endeavours to raise taxes on the tremendous-abundant as the new administration seeks to minimize reliance on financial loans to fund the countrywide finances and finance the President’s pro-inadequate designs amid the burgeoning community debt.

Read through: Applying new taxes robs elegance from the cosmetics field

But it appears to be like established to face opposition amid the tremendous earners it is concentrating on.

The Ruto administration’s 1st budget will extend by Sh215.03 billion compared with the present a person well prepared by its predecessor to Sh3.6 trillion for the 12 months beginning July.

The Treasury has been underneath pressure from the International Monetary Fund (IMF) to double the benefit-additional tax (VAT) on all petroleum goods in an exertion to lower the spending plan deficit and tame general public borrowing.

Previous President Kenyatta was in 2018 compelled to halve VAT on gasoline to 8 per cent just after the introduction of the full tax prompted protests from motorists and business lobbies.

The tax was originally integrated in a regulation handed in 2013, but was postponed numerous periods, amid issues about its impact.

Now, the IMF is inquiring Kenya to contemplate the gasoline tax at a time when the multilateral loan company is envisioned to participate in a position in shaping plan that would need the authorities to employ tricky conditions throughout a lot of sectors.

[ad_2]

Source backlink