[ad_1]

DE Shaw is 1 of the greatest-grossing hedge resources in record (number 3 as of conclusion-2022), but with zero ability in its key quant-oriented financial investment autos it has extended looked for new methods to extract service fees serve customers.

In recent many years the most important method has been to establish up DE Shaw Expenditure Management, which is targeted on a lot less juicy, very long-only and higher-capacity systematic investment decision tactics like as “risk premia”. The business manages about $20bn (DE Shaw is very opaque on the split of its $60bn-in addition belongings below management) but has flatlined in modern yrs, leading to a hunt for a little something new.

So this information makes a whole lot of feeling:

New York, February 14, 2023 — The D. E. Shaw team, a international expense and technologies improvement company, now introduced that it has elevated $1.1 billion in blended commitments for two new cash, D.E. Shaw Voltaic Fund and D. E. Shaw Diopter Fund, centered on private market place financial investment possibilities. The firm’s entities, principals, and employees contributed far more than $150 million in total to the new cash. These fundraises signify the newest milestone in the prolonged-term buildout of the firm’s non-public investing strategies.

DE Shaw has managed tiny standalone credit money due to the fact 2008, and has very long dabbled in modest non-public fairness investments, but Voltaic — concentrated on publish-seed and progress equity stages — is its to start with standalone undertaking cash fund.

In a indicator of the messy VC fundraising surroundings, Voltaic’s $450mn fell below DE Shaw’s original $500mn concentrate on. And at the very least some of that money came from DE Shaw insiders, who contributed $150mn of the $1.1bn merged fundraising announced now.

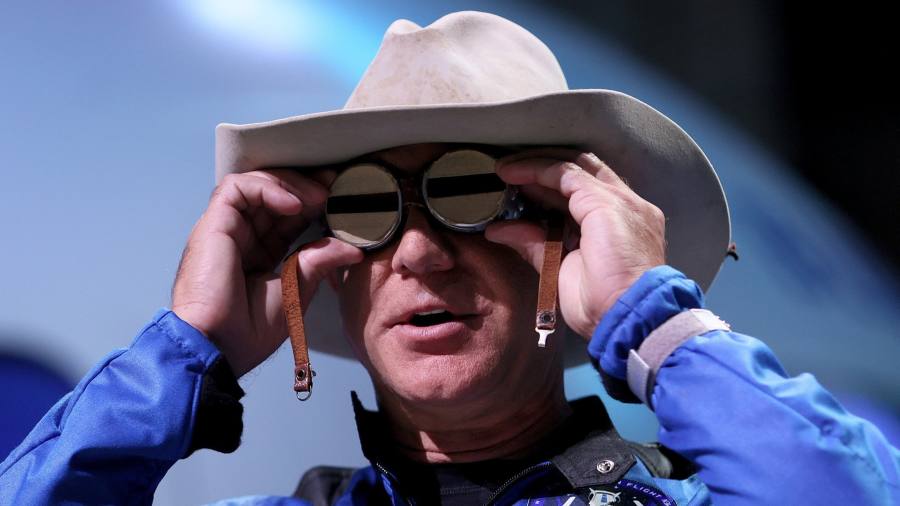

Nevertheless, the new launch tickled FT Alphaville simply because some non-quant-obsessed normies primarily know DE Shaw as the hedge fund where Jeffrey Bezos worked ahead of he started out Amazon.

It is quite possibly not strictly correct that David Shaw straight-up handed on investing in Amazon, but the plan of starting off an on the web bookseller that could turn out to be an “Everything Store” certainly bought its genesis in DE Shaw’s exploration of several world wide web ventures.

Again in the early 1990s, DE Shaw made and financed a number of other on the net organizations, such as e-mail support Juno (which went public in 1999 and was finally subsumed by a rival) and online brokerage FarSight (which Merrill Lynch inevitably acquired). Here’s an excerpt from Brad Stone’s e-book about Amazon:

Various executives who labored at DESCO at that time say the strategy of the all the things retailer was very simple: an Web corporation that served as the middleman in between consumers and producers and marketed nearly every style of products, all in excess of the entire world. A person important factor in the early eyesight was that buyers could depart penned evaluations of any item, a more egalitarian and credible model of the outdated Montgomery Ward catalog opinions of its own suppliers. Shaw himself verified the Net-store concept when he explained to the New York Instances Journal in 1999, “The idea was constantly that another person would be allowed to make a earnings as an middleman. The important query is: Who will get to be that intermediary?”

But as an alternative of accomplishing it in-house, Bezos still left DE Shaw to begin what would come to be Amazon solo — with Shaw’s blessing, and seemingly, none of his cash. In the pantheon of good skipped options that ranks really highly.

DE Shaw follows Man Group and Two Sigma into the group of hedge money wanting to deploy their solution in non-public marketplaces. It’ll be challenging to do even worse than some of the advancement-jockey crossover hedge funds have accomplished these days, just after all.

And David Shaw looks to be accomplishing pretty well in his new gig curing illnesses.

Additional reading through:

[ad_2]

Source website link