[ad_1]

US stock futures traded in a very tight range on Wednesday as investors held off on making big trades ahead of today’s CPI print which is expected to provide clues on the Federal Reserve’s outlook for rate hikes. Contracts on the S&P 500 were up 0.2% at 7:45am ET while Nasdaq futures were fractionally in the red. The Bloomberg Dollar Spot Index was little changed, as Treasury yields edged higher across the curve, mirroring moves in European bond markets. Oil and gold rose. Bitcoin was flat after a four-day gain, its longest streak in three weeks.

Among notable movers in premarket trading, Bed Bath & Beyond climbed 2.6% after the troubled retailer raised $48.5 million through a share sale as it seeks cash to avert bankruptcy. Nutex Health jumped as much as 34% after the health care management company said that it has entered into a $100 million pre-paid advance agreement with Yorkville Advisors Global. Here are some other notable premarket movers:

- MongoDB (shares rise 3.4%, while Confluent gains 4.8%, after both are upgraded to overweight from equal-weight at Morgan Stanley, as the broker expects faster and increased expenditure on the transition of companies to the public cloud.

- National Instruments gains 6.5% after Bloomberg reported, citing people familiar, that Emerson Electric (EMR) is in advanced talks to acquire the maker of measurement systems.

- Shares in midcap financial advisory firms may be in focus as Morgan Stanley sees a rebound for the sector pushed out to 2024, in a note upgrading Evercore and Lazard and cutting Jefferies Evercore was also raised at UBS on Tuesday.

- Keep an eye on Becton Dickinson (BDX) as it was raised to overweight from sector weight at KeyBanc Capital, which says it believes the medical- technology company can finally break out of its trading range of the past five years given reasonable valuation and focus on meeting long-term financial targets.

With stocks stuck in a 30 point range around 4,120 for much of April, traders are now looking at today’s CPI print to break the stalemate with the next clue on the path of Fed rate hikes with economists expecting to see a further softening in price pressures as CPI shows a slowdown in headline CPI to 5.1% in March from 6.0% a year ago (our full preview is here); while a stronger reading could boost the US currency, strategists expect that concerns over the negative economic impact from tighter credit conditions will limit any significant gains in the near term. Overnight-indexed swaps are pricing in a roughly 75% possibility of a 25 basis point hike in May, followed by a cut of a similar size as early as September.

“Markets have recently taken the view that the Fed needs to ensure stability in the financial system. That means easing back on rate hikes which could topple the economy,” said Russ Mould, investment director at AJ Bell. “However, the reason why rates have been going up so fast over the past 12 months is down to rising inflation, so today’s update will still matter to the Fed.”

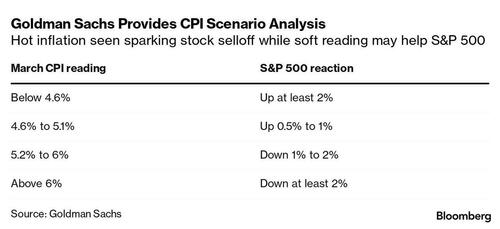

As we first reported yesterday, Goldman trader John Flood offered guidelines for what investors can expect from the market when the data appear.

“Markets are super-sensitive to any indication that the Fed will stay aggressive in its inflation fighting stance, and the worry is that core inflation may be proving harder to bring down more quickly, which could harden policymakers’ resolve,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Meanwhile, Goldman Sachs strategists said equity volatility is likely to increase in the second quarter amid slowing growth, elevated macro uncertainty and market stress. Focus later this week will turn to the start of the first-quarter reporting season for Corporate America. One measure shows that equities have seen the biggest pre-earnings rally since early 2009 even as first-quarter profits are forecast to drop 8%.

European stocks are on course for a third consecutive gain with the Stoxx 600 touching a five-week high. The regional benchmark is up 0.2% with real estate, media and utilities the best-performing sectors. The FTSE 100 has outperformed with gains of 0.6% led by AstraZeneca and Shell. Here are some of the most notable premarket movers:

- Volvo gained as much as 9.6%, the most intraday since March 2020, after first-quarter preliminary results came in ahead of expectations, with the Swedish truck and bus maker beating analyst views on sales, operating income and margins.

- Grifols jumped as much as 6.9% after Morgan Stanley upgraded to overweight with the threshold for outperformance now low because of “depressed” valuation and sentiment on the stock.

- Two big sell orders for TUI rights put pressure on the rights’ pricing and shares, which fell as much as 4.4% in Frankfurt.

- Merck fell as much as 6.4% after the pharmaceutical company said the FDA has placed a partial clinical hold on the initiation of new patients on Evobrutinib and patients with less than 70 days exposure to study medication in the US.

- French re-insurer Scor rose as much as 3.9% after the company updated its 2023 targets under the new IFRS 17 accounting standard, reassuring investors about its operational turnaround and dividend prospects.

- L’Oreal fell as much as 1.6% after Deutsche Bank cut its rating to hold from buy, saying the share price now fully takes account of the French cosmetics firms’ defensive characteristics and the reopening of the Chinese economy.

Earlier in the session, Asian stocks fluctuated in a narrow range as investors awaited US inflation data. The MSCI Asia Pacific Index swung between gains and losses as communication shares fell and material stocks rose. Japan’s stock market was the region’s best performer, extending gains after media reports on Tuesday said Warren Buffett is turning his focus back to the nation’s equities. “Yesterday’s news report on Buffett was viewed positively,” said Tomo Kinoshita, a strategist at Invesco Asset Management Japan. In addition, the yen’s depreciation and expectations that the Bank of Japan will keep its current policy are supporting Japanese equities, Kinoshita added. The Topix Index rose 0.8% to 2,006.92 as of market close Tokyo time, while the Nikkei advanced 0.6% to 28,082.70. Today’s gains followed an advance in Japan stocks on Tuesday, after the Nikkei reported Warren Buffett is weighing investment beyond his stakes in Japanese trading houses. Trading companies including Mitsui & Co and Mitsubishi Corp were among the main contributors to the Topix’s gain. Out of 2,158 stocks in the index, 1,523 rose and 526 fell, while 109 were unchanged.

Benchmarks also advanced in Australia and South Korea ahead of the US inflation figures that could serve as a crucial factor for the Fed’s next policy meeting. Conditions including credit tightening from stricter bank regulations, higher crude oil prices and inflation are boosting the risk of a US recession, according to JPMorgan strategist Rie Nishihara. Read: Fed Officials Signal Divide Over Whether to Hike Rates Again (2) Chinese technology shares fell, with Tencent tumbling by the most in over two months, amid speculation its largest shareholder Prosus NV may speed up the selling of the Chinese tech firm’s stock

Australian stocks advanced to a five-week high, with the S&P/ASX 200 index rising 0.5% to close at 7,343.90, lifted by miners and health shares. The advance comes as investors weigh the potential for US inflation data due Wednesday to spur volatility across global markets. In New Zealand, the S&P/NZX 50 index rose 0.4% to 11,917.50

Indian stock gauges rose for an eighth straight day as investors expect upcoming earnings season to support further recovery in local shares. The S&P BSE Sensex rose 0.4% to 60,392.77 in Mumbai, while the NSE Nifty 50 Index advanced 0.5% to 17,812.40. The recent rally in key benchmarks has pushed the guages to their highest level since Feb. 21, helping trim their annual losses. Nifty 50 companies’ quarterly revenue and profit are estimated to expand 11% and 12% respectively, with financials and auto firms reporting strong growth, analysts at Axis Securities, wrote in a note. The govt will release release consumer price inflation and industrial production data later on Wednesday. Markets in India will be closed on Friday due to a local holiday. HDFC Bank contributed the most to the index gain, increasing 1.3%. Out of 30 shares in the Sensex index, 17 rose, while 13 fell.

In FX, the Bloomberg Dollar Spot Index was largely unchanged, after falling 0.2% on Tuesday. The dollar was mixed against major currencies; USD/JPY rose 0.1% to 133.79, EUR/USD up 0.1% at 1.0924 as G10 pairs trade in tight ranges ahead of the release of the US CPI report. The exception is the Swedish krona, which rallied as much as 0.8% versus the greenback; EUR/SEK down 0.5% to 11.3578, after falling as much as 0.7%. NOK/SEK drops 0.5% to 0.9857, eyes March triple-bottom at 0.9725-26. NOK/SEK is a consensus long position, according to Nomura strategist Jordan Rochester; Wednesday’s price moves may therefore reflect “continued unwinding” of that position after prior day’s softer PPI data from Norway.

In rates, treasuries are flat, reversing an earlier drop into the early US session, where early focus turns to March inflation data. Cash yields flat to cheaper by 2bp across the curve with losses led by front-end, although 2-year yields remain inside Tuesday’s range. 10-year yields are around 3.43%, cheaper by ~1bp vs Tuesday’s close with 2s10s, 5s30s spreads both flatter by ~1bp amid front-end led losses; two-year TSYs are up 1bp to 4.03%. German two-year yields are up 5bps, richer by 1bp vs Treasuries while gilts outperform by ~3bp. US auction cycle continues with $32b 10-year note reopening, following Tuesday’s sold 3-year sale which stopped on the screws. WI 10-year yield around 3.45% is below auction stops since September and more than 50bp richer than last month’s result.

In commodities, crude futures edge higher with WTI adding 0.3% to trade near $81.75. Spot gold rises 0.3% to around $2,010. Bitcoin falls 0.6%.

Looking at today’s main events, the main highlight will be the US CPI release for March. Otherwise from central banks, we’ll get the release of the FOMC minutes from the March meeting, as well as a policy decision from the Bank of Canada. Speakers will include BoE Governor Bailey, ECB Vice President de Guindos, the ECB’s De Cos and Villeroy, and the Fed’s Barkin and Daly. Finally, G20 finance ministers and central bank governors will be meeting.

Market Snapshot

- S&P 500 futures up 0.1% to 4,142.00

- STOXX Europe 600 up 0.3% to 463.03

- MXAP little changed at 162.01

- MXAPJ down 0.3% to 524.65

- Nikkei up 0.6% to 28,082.70

- Topix up 0.8% to 2,006.92

- Hang Seng Index down 0.9% to 20,309.86

- Shanghai Composite up 0.4% to 3,327.18

- Sensex up 0.3% to 60,366.48

- Australia S&P/ASX 200 up 0.5% to 7,343.88

- Kospi up 0.1% to 2,550.64

- German 10Y yield little changed at 2.31%

- Euro little changed at $1.0919

- Brent Futures little changed at $85.61/bbl

- Gold spot up 0.3% to $2,010.25

- US Dollar Index little changed at 102.14

Top Overnight News

- Data from Chinese travel apps suggests travel activity in the country has returned to pre-pandemic levels and is set to boom during the upcoming May Day holiday (April 29-May 3). RTRS

- The renminbi’s share of trade finance has more than doubled since the invasion of Ukraine, analysis by the Financial Times has found — a surge that analysts say reflects both greater use of China’s currency to facilitate trade with Russia and the rising cost of dollar financing. FT

- China launches a “trade barrier investigation” into Taiwan’s “restrictive measures” imposed on mainland products. SCMP

- BOJ deputy governor reiterates the message delivered Monday by Ueda, promising to continue with an easing bias to ensure achievement of the inflation objective. RTRS

- The U.S. affiliate of the world’s largest crypto exchange said it will stop facilitating trades in the digital tokens TRX and Spell following a review. Binance.US didn’t give specific reasons for its decision, but said its periodic reviews of digital assets consider factors such as their regulatory standing in the U.S., trading volume and liquidity, and changes in their risk profile. WSJ

- Silicon Valley investors are touring the Middle East, seeking to build long-term ties with sovereign wealth funds during the worst funding crunch for venture capital firms in almost a decade. FT

- A report from the New York Fed warns that banks face further upside pressure in deposit costs and deposit betas (deposits will likely continue exiting the banking system in search of more attractive yields elsewhere). NY Fed

- Crude holdings at Cushing contracted by 1.4 million barrels last week, the API is said to have reported. That would be a sixth drawdown if confirmed by the EIA. Overall, US supplies rose 400,000 barrels. In OECD nations, stocks surged by more than 115 million barrels from the start of 2022 through February this year, OilX said, spurred in part by supplies from government reserves. BBG

- Elon Musk said most of the advertisers who abandoned Twitter have returned. He reaffirmed the company’s operating at about breakeven and may be cash-flow positive this quarter. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks saw a mixed session following a similar lead from Wall Street in the run-up to the risk-packed session. ASX 200 was once again propped up by mining names, with industrial metals underpinned by the recent Dollar decline. Nikkei 225 extended further above 28k, with the index buoyed by recent bullish comments from Warren Buffett on Japanese stocks ahead of a three-hour CNBC interview from Tokyo. Hang Seng and Shanghai Comp were mixed with the former underperforming amid losses in large-cap stocks (JD.com, Alibaba, Tencent) following weakness from Stateside peers.

Top Asian News

- China is reportedly negotiating a compromise plan with other major creditors that could help break a logjam in multibillion-dollar debt-relief talks for struggling developing nations, according to WSJ citing sources.

- IMF Financial Stability Report said changes to the BOJ’s Yield Curve Control (YCC) may affect international financial markets through three channels of exchange rates, term premiums on sovereign bonds, and global risk premiums, according to Reuters.

European bourses are essentially unchanged in-fitting with broader price action ahead of the packed US docket, Euro Stoxx 50 +0.2%. Sectors are mixed, with magnitudes slim, as Media leads amid UMG upside with a slight pro-defensive bias in play. Stateside, futures are in-fitting with the above as participants are entirely focused on CPI and Fed speak thereafter, ES +0.1%.

Top European News

- ECB’s Villeroy said we now face the risk of entrenched inflation, price growth has become more widespread, and potentially more persistent. He added the ECB’s policy response is now moving from a “sprint” to a “long-distance race”, and the ECB is fully committed to reining inflation, according to Reuters.

- US President Biden and UK PM Sunak to meet at 11:15BST/06:15EDT; Biden is to deliver remarks at 13:00BST/08:00EDT, according to The White House.

- Swiss Lower House voted to retrospectively reject the CHF 109bln Credit Suisse (CSGN SW) rescue package, according to Reuters.

- UK-US free trade discussions are unlikely to resume until 2025 at the earliest when a new President could be in place, according to the Telegraph.

FX

- The DXY is in close proximity to the neutral mark after somewhat mixed Fed commentary overnight and ahead of inflation with other catalysts limited, DXY holding above 102.00.

- Action which is lending some modest support to most G10 peers, with EUR outpacing somewhat in narrow 1.0912-1.0937 parameters while GBP is slightly softer and seemingly tied to 1.24.

- Antipodeans are similarly near the unchanged mark, with AUD faring slightly better than its peer but off best after remarks from RBA’s Bullock.

- JPY has exhibited a comparably large range thus far and is currently holding at the mid-point of 133.56-134.04 boundaries as it digests firmer data and a reiteration from Uchida.

- PBoC set USD/CNY mid-point at 6.8854 vs exp. 68843. (prev. 6.8882).

Fixed Income

- Debt continues to drift lower despite bouts of consolidation around supply and China-Taiwan geopolitics which have failed to markedly alter the tone pre-CPI/US supply.

- Specifically, the German conventional and subsequent UK I/L sale were well received, particularly the latter, though both Bunds and Gilts remain near their 135.46 and 103.09 troughs.

- Stateside, USTs are similarly softer with yields slightly bid and action a touch more pronounced at the long-end of the curve.

Commodities

- Overall, the commodity space is in-fitting with broader market action and as such is relatively contained ahead of US CPI and numerous Central Bank speakers/events.

- WTI and Brent are within touching distance of the unchanged mark within parameters less than USD 0.50/bbl as specific newsflow has been essentially non-existent aside from China-Taiwan geopolitics.

- ICE announces it is to implement expiry limits on Dutch TTF natural gas futures, effective for June 2023 TTF natural gas futures contract expiry. ICE Endex will introduce expiry limit of 7k lots in TTF for the last 5 trading days prior to expiry.

- Spot gold continues to hold above the USD 2k mark and has increased the gap somewhat when compared to Tuesday’s action from its 10-DMA at USD 1994/oz; elsewhere, base metals are mixed.

Geopolitics

- US House is set to vote next week on a bill to address potential Huawei and ZTE threats, according to Reuters.

- Taiwan’s defence ministry said in the past 24 hours spotted 35 Chinese aircraft and 8 Chinese ships around Taiwan, according to Reuters.

- North Korea remains unresponsive to regular contact via the inter-Korean liaison line for a sixth day, according to Yonhap.

- US National Security Adviser Sullivan spoke with Saudi Crown Prince MBS on Tuesday, and they discussed global and regional matters and ongoing diplomacy related to ending the war in Yemen, according to Reuters.

- China has confirmed it is willing to work with the Australian government to resolve tariff disputes over both wine and barley exports, according to AFR.

- China’s Foreign Ministry held a Sino-Dutch consultation on arms control and non-proliferation in Beijing on Tuesday, according to a ministry statement.

- China plans to impose a no-fly zone north of Taiwan during April 16th-18th, via Reuters citing sources; subsequently, the window has been reduced to 27minutes on the 16th for a “falling object related to a launch vehicle” according to S. Korea.

- China and Russia are in advanced discussions with Iran to replenish Iran’s supply of a chemical compound which is used to propel ballistic missiles, via Politico citing sources; would be a clear violation of UN sanctions, article adds.

US Event Calendar

- 07:00: April MBA Mortgage Applications +5.3%, prior -4.1%

- 08:30: March CPI YoY, est. 5.1%, prior 6.0%; MoM, est. 0.2%, prior 0.4%

- 08:30: March CPI Ex Food and Energy YoY, est. 5.6%, prior 5.5%; MoM, est. 0.4%, prior 0.5%

- 08:30: March Real Avg Hourly Earning YoY, prior -1.3%

- 08:30: March Real Avg Weekly Earnings YoY, prior -1.9%

- 14:00: March FOMC Meeting Minutes

- 14:00: March Monthly Budget Statement, est. -$314b, prior -$192.6b

DB’s Craig Nicol concludes the overnight wrap

As markets got going again after the long weekend, sovereign bonds have seen a further selloff thanks to growing expectations that the Fed will deliver another rate hike next month. In part that’s a function of good news, since we haven’t had additional market turmoil since March, and yesterday saw Bloomberg’s index of US financial conditions ease to its most accommodative level since SVB’s collapse. But at the same time, there’ve also been some more negative factors driving that. In particular, inflation has continued to run at a rapid clip, so today’s US CPI release for March will be an important print as investors try to get a steer on whether they’ll hike.

In terms of what to expect from the CPI release, our US economists are looking for headline CPI to come in at a monthly +0.24%, which would take the year-on-year rate down to +5.2%. However, they see core CPI at a more robust +0.39%, which would take the year-on-year rate up a tenth to +5.6%. Last month’s print was further down the headlines thanks to the SVB-related turmoil, but it still showed that core CPI was at a 5-month high of +0.45%, and the components pointed to inflation that remained broad-based and sticky. So the Fed will want to see more progress before they can be comfortable with the inflation numbers.

As investors awaited the CPI print, markets moved to price in a growing chance of a rate hike in three weeks’ time. For instance, futures have increased the chances of a 25bp hike to 74% this morning, which is the highest level since SVB was taken over by regulators on March 10. The end-2023 rate is also at a post-SVB high this morning of 4.42%. In turn, that’s meant a further rise in Treasury yields, with the 2yr yield moving higher for a 4th consecutive session yesterday, with a +1.5bps gain to 4.02%, and overnight it’s risen a further +1.0bps to 4.03%. The 10yr yield also rose +0.9bps yesterday to 3.43%, and overnight it’s added a further +0.4bps.

The prospect of another Fed hike was given some support by various FOMC speakers yesterday. Early in the session, New York Fed President Williams said that the Fed’s median forecast for a further rate hike was a “reasonable starting place”. And later in the session, Philadelphia Fed President Harker said that he wanted to “get rates above 5 and then sit there for a while”, which would imply at least one more 25bp move. However, Chicago Fed President Goolsbee struck a notably more dovish tone relative to some recent speakers, saying that the Fed should “be careful about raising rates too aggressively until we see how much work the headwinds are doing for us in getting down inflation.”

Much like treasuries, equities were fairly steady before sinking into the close as the more rates-sensitive growth sectors like software (-1.4%) and semiconductors (-0.8%) led the declines. However, technology was about the only sector negative on the day with moderate gains elsewhere. As such, the S&P 500 was flat, but the NASDAQ fell -0.43% and the FANG+ index fell -1.45%. European equities put in a stronger performance, but that reflected the fact they hadn’t been open since Thursday, and the STOXX 600 saw a larger gain of +0.62%. For sovereign bonds there was a similar catchup in Europe following Friday’s US jobs report, and yields on 10yr bunds (+12.8bps), OATs (+12.4bps) and BTPs (+14.0 bps) all saw a solid increase.

Another trend that isn’t helping on the inflation side has been the recent rebound in oil prices. That continued yesterday, with Brent crude closing at a one-month high of $85.50/bbl, whilst WTI closed at a two-month high of $81.53/bbl. That came as the US Energy Information Administration released their short-term energy outlook, which showed Brent crude averaging at $85/bbl in 2023, and $81/bbl in 2024, both up on the previous month’s forecast.

Overnight in Asia, equity markets are have been putting in a mixed performance ahead of the US CPI release later today. Currently, the Nikkei (+0.64%) is outperforming, with the Shanghai Comp (+0.47%), the KOSPI (+0.22%) and the CSI 300 (+0.16%) also advancing. The main exception to that has been the Hang Seng (-0.59%). Otherwise, US equity futures have been flat this morning, with those on the S&P 500 (+0.04%) and the NASDAQ 100 (+0.01%) pointing to little change.

Elsewhere yesterday, the IMF released their latest economic forecasts for the global economy, which pointed to modest downgrades relative to their last update in January. They now see global growth at +2.8% in 2023 and +3.0% in 2024, which are both down by a tenth relative to three months ago. However, a few places did see some upgrades, with the US now expected to grow by +1.6% in 2023 (vs. +1.4% in January) and the UK projected to contract by -0.3% (vs. -0.6% in January). More broadly though, the IMF pointed out that the risks were “heavily skewed to the downside, with the chances of a hard landing having risen sharply.”

There wasn’t much other data to speak of yesterday. Euro Area retail sales contracted by -0.8% in February as expected but the previous month’s expansion was revised up half a point to +0.8%. Otherwise in the US, the NFIB small business optimism index for March fell to a three-month low of 90.1 (vs. 89.8 expected). One interesting point was that a net 9% of small business owners who borrow frequently said that financing was more difficult to obtain compared to three months earlier, which is the worst score on that in just over a decade. The previous month it had only been a net 5%, and that shift of 4 points lower in a month was the biggest monthly decline since December 2002.

To the day ahead now, and the main highlight will be the US CPI release for March. Otherwise from central banks, we’ll get the release of the FOMC minutes from the March meeting, as well as a policy decision from the Bank of Canada. Speakers will include BoE Governor Bailey, ECB Vice President de Guindos, the ECB’s De Cos and Villeroy, and the Fed’s Barkin and Daly. Finally, G20 finance ministers and central bank governors will be meeting.

Loading…

[ad_2]

Source link